LinkDaddy Google Business Profile Management Solutions

Wiki Article

Changing Your Approach to GBP Monitoring

In the realm of international economic markets, managing the British Pound (GBP) needs a critical and meticulous method that goes past standard techniques. As the characteristics of the GBP market proceed to develop, experts are tasked with reassessing their administration approaches to remain in advance of the contour. By executing ingenious threat monitoring strategies, leveraging cutting-edge technologies for extensive analysis, and branching out investment portfolios, a new age of GBP administration emerges. There is an essential facet yet to be checked out, one that might potentially redefine the method GBP is managed on an international scale.Comprehending GBP Market Dynamics

The understanding of GBP market dynamics is crucial for making educated choices in foreign exchange trading. The GBP, additionally recognized as the British Pound, is one of one of the most traded currencies in the globe. Its value is affected by different factors such as financial data, geopolitical occasions, and market belief. By gaining understandings into these characteristics, traders can much better anticipate possible cost movements and readjust their techniques as necessary.Economic indications play a substantial role in forming the GBP's performance. Trick elements to check consist of GDP development, rising cost of living rates, unemployment numbers, and rate of interest decisions by the Bank of England. Favorable economic data typically enhances the extra pound, while negative data can cause devaluation.

Geopolitical occasions can also influence the GBP's worth. Brexit, for instance, has actually been a significant driver of volatility in recent times (linkdaddy google business profile management). Modifications in federal government policies, trade arrangements, and international events can all influence market belief and the GBP's instructions

Applying Risk Administration Approaches

Leveraging Innovation for GBP Evaluation

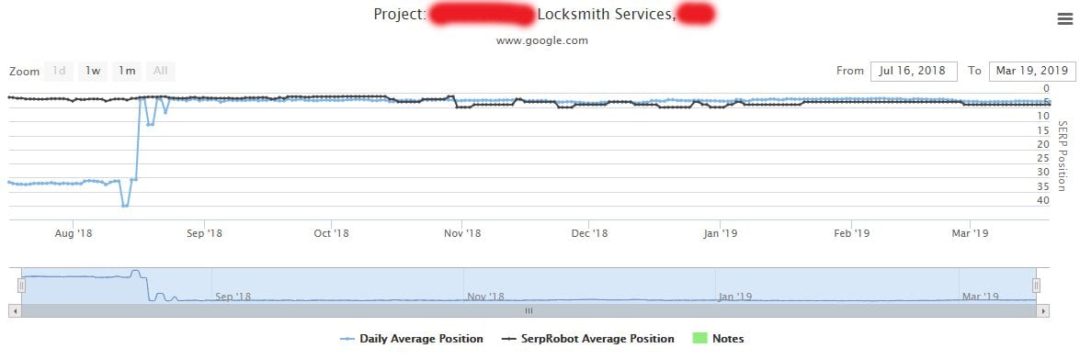

Utilizing sophisticated technical tools improves the accuracy and performance of evaluating GBP market fads and characteristics. By leveraging technology for GBP analysis, monetary specialists can access real-time data, automate repetitive tasks, and perform in-depth statistical modeling easily. One key technology that helps in GBP evaluation is fabricated intelligence (AI), which can process huge quantities of data at a speed unrivaled by human beings. AI formulas can identify patterns and connections in the GBP market, giving useful insights for decision-making.Furthermore, information visualization devices play a crucial function in streamlining intricate information establishes right into conveniently absorbable charts and graphes. These devices make it possible for analysts to spot trends, GBP management opportunities, and abnormalities rapidly. Additionally, artificial intelligence formulas can be trained to forecast GBP market motions based on historic information, assisting to direct strategic choices.

Diversifying GBP Financial Investment Portfolios

With a strong foundation in leveraging modern technology for GBP analysis, economic experts can currently tactically expand GBP investment profiles to optimize returns and alleviate risks. Diversification is a basic principle that entails spreading financial investments throughout different possession courses, markets, and geographical regions. By branching out a GBP profile, investors can minimize the influence of volatility in any solitary property or market sector, possibly boosting overall efficiency.One reliable way to branch out a GBP financial investment portfolio is by designating properties across various kinds of safety and securities such as equities, bonds, real estate, and products. This approach can help balance the profile's risk-return account, as various asset classes have a tendency to act differently under various market problems.

Tracking GBP Efficiency Metrics

To effectively assess the efficiency of a GBP financial investment portfolio, financial professionals have to concentrate on crucial performance metrics that supply insights into its profitability and threat monitoring. Tracking GBP performance metrics is crucial for making educated choices and optimizing profile end results.Volatility metrics such as typical variance and beta are also important indications of danger. Basic deviation gauges the dispersion of returns, highlighting the profile's security or variability, while beta analyzes its sensitivity to market movements. Recognizing these metrics can help in managing threat exposure and readjusting the portfolio's allocation to fulfill desired threat levels.

Furthermore, tracking metrics like Sharpe proportion, details proportion, and drawdown analysis can offer much deeper understandings right into risk-adjusted returns and downside security. By methodically keeping an eye on these efficiency metrics, economic professionals can fine-tune GBP investment methods, boost efficiency, and far better browse market variations.

Verdict

In conclusion, revolutionizing the method to GBP administration includes understanding market dynamics, carrying out threat administration strategies, leveraging innovation for analysis, branching out investment profiles, and monitoring efficiency metrics. By including these vital aspects into your GBP management method, you can enhance your decision-making process and accomplish greater success in browsing the complexities of the GBP market.

With a solid structure in leveraging technology for GBP evaluation, monetary specialists can now strategically branch out GBP investment profiles to optimize returns and minimize dangers.

Report this wiki page